Every Time you make a buy order that wants guaranteed funds, but you don’t wish to give somebody cash, you would use a cashier’s examine or money order as an alternative. Provided only through a monetary institution, cashier’s checks offer safety for purchases of bigger quantities such as real property transactions. Read on to learn extra about how cashier’s checks and cash orders differ and when to use which choice. Understanding the distinction between cashier’s checks and money orders is crucial when it comes to financial transactions.

If you may have a checking account, you’ve probably written a examine in some unspecified time within the future, whether it was to pay a bill or present cash to a loved one. And personal checks are largely adequate for smaller day-to-day transactions. However when you have to send someone a big amount of money, you may seek different options which might be a bit more secure.

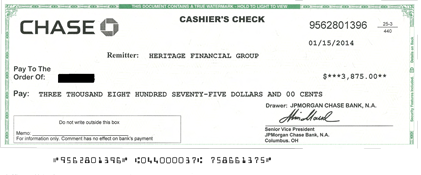

Legitimate lotteries don’t often ask folks to pay charges to assert a prize. Since a cashier’s verify is a assured type of cost, the recipient can typically deposit or money it with none maintain once they receive it. Cashier’s checks are payment instruments that banks problem out with the assure that the bank is liable for the funds, rather than the person sending them.

Cashier’s Examine Vs Money Order

When a banking institution issues a cashier’s verify, it is signed by an authorized official, similar to a cashier or bank officer, further ensuring its authenticity. These further layers of security make cashier’s checks an applicable option for large transactions and conditions where https://www.simple-accounting.org/ fraud might be a priority. Losing a cashier’s check is far completely different than dropping a private check since this sort of verify typically can’t be stopped immediately.

Some banks cost a payment to prospects to problem a cashier’s check. PNC Financial Institution, for example, costs as much as $10 per verify depending on the account type. Whether users must pay contractors, cowl month-to-month bills, or carry out other transactions, PayPal can streamline how individuals make and manage invoice funds. Dive into this information to find the essential distinction between cashier’s checks and cash orders and how they may be the solution for sure transactions. While cash orders are extra affordable than cashier’s checks, the payment distinction is relatively small.

Some scammers settle for only money orders or cashier’s checks for products they sell on-line. Nonetheless, once you ship them your cost, you may by no means really receive what you ordered otherwise you may get one thing completely different than expected. As Quickly As your cash is gone, there’s a good probability you will not see it once more.

Shopping For Cash Orders Vs Cashier’s Checks

- For cashier’s checks, you’ll must contact the issuing bank and provide a copy of the original receipt.

- Second, since cash orders are still less safe than cashier’s checks, the preliminary money out there may be much less when the payee makes the deposit.

- Cashier’s checks, then again, are normally available solely from a financial establishment where you are a member.

- A cashier’s examine is a examine issued and guaranteed by a financial institution or credit score union.

- Nevertheless, it’s generally lower than the maximum for cashier’s checks.

As long as you have the receipt, you’ll find a way to trace the money order or try to recover the funds when you lose it and it hasn’t been used yet. Cashier’s checks are perfect for giant funds the place you need guaranteed funds, such as for buying a automobile, making a down fee on a home, or finishing a large enterprise transaction. As A End Result Of the bank guarantees the funds, the recipient has confidence that the examine won’t bounce. Now that we have examined the differences between cashier’s checks and money orders, let’s tackle some incessantly asked questions to supply further clarity.

Depending on the financial institution, you can do the process online or by telephone quite than coming in individual; stepping into individual is the fastest choice, and you will need to indicate your ID. When you get the check and receipt, present the cashier’s examine to the payee. Money orders are useful for small transactions where you need a safe form of fee but don’t wish to use money or checks. For instance, they’re often used to pay rent, utility bills, or to send cash internationally.

One way to shield your self is to verify a cashier’s check with the issuing bank before finishing the transaction, especially when coping with somebody you don’t know. See tips on how to get one, when to use them, and how they offer safe cost alternatives to personal checks. Many banks and credit unions offer cashier’s checks although some differ on terminology, calling them “official checks.” Ask your monetary establishment for availability and pricing. Some monetary institutions supply decreased charges or no charges for certain account holders. A cash order is a safe fee tool that can be used as an different to personal checks and cash. In Distinction To writing a private examine, a money order represents pay as you go funds, eliminating the danger of inadequate funds when the recipient deposits or cashes it.

Checking accounts are for normal transactions, while financial savings accounts are best for saving. Since there isn’t any bodily department, the sender will usually order the verify online or by phone and then the bank will mail it to them or on to the recipient. This means it’ll take longer to obtain compared to choosing one up in individual. With guaranteed funds from the issuer, the recipient can rest easy figuring out that the funds will clear and be available to them quickly. Banks usually deduct charges instantly from the payer’s account together with the check amount and will not problem the cashier’s examine until these funds are secured. When on the bank, individuals should clearly state the exact quantity they need the cashier’s examine to be for.